Redphotographer/iStock by way of Getty Photos

After I final coated Bitcoin (BTC-USD) I mentioned the highest crypto asset by market cap was approaching my purchase zone. Within the two months since that article was revealed, we’ve seen the value plummet via the decrease finish of that zone. Whereas I can freely admit I acquired that decision unsuitable, I do wish to revisit the present setup for many who view Bitcoin as a multi-year maintain relatively than as a month-to-month maintain.

Understanding the mining course of

Like gold, Bitcoin is “mined.” Albeit via a totally completely different type of mining. Gold and different metals are mined out of the bottom. Bitcoin and different cryptocurrencies are mined out of code. The notion that Bitcoin is created merely out of skinny air will not be correct in my opinion. It takes an amazing quantity of vitality to reward “miners” with freshly created Bitcoin. The Bitcoin is rewarded for securing the community and verifying transactions. When there are extra miners securing the community, the hash-rate will increase.

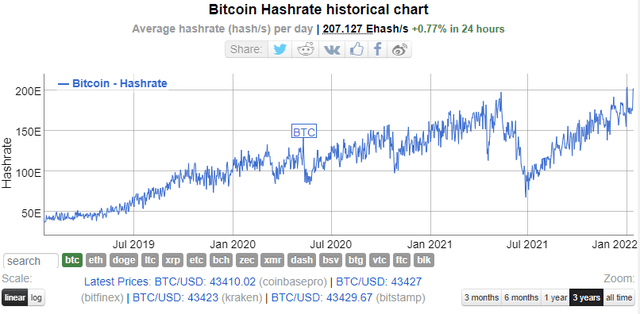

Bitinfocharts.com

Final 12 months when China banned Bitcoin, the hash-rate took a dive as China-based mining operations began to come back offline. That hash-rate has since recovered and the Bitcoin community is simply as safe as ever. With extra miners coming on-line competing for a similar Bitcoin provide, the issue within the block reward has elevated.

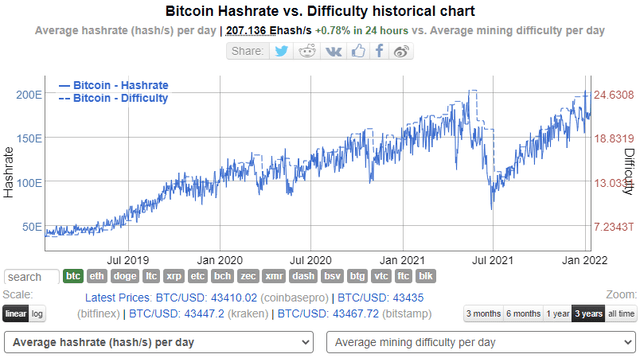

bitinfocharts.com

You possibly can see within the chart above that I’ve added a dotted line that represents the issue related to mining Bitcoin. Because the hash-rate will increase, issue strikes nearly in lockstep. Which means it requires extra vitality expense to mine the identical Bitcoin.

Miner profitability

The issue that miners now discover themselves in is one among increased enter prices with a decrease Bitcoin value. Their margin is taking a beating. And to be clear, that is largely by design. Bitcoin goes to proceed to get harder to mine because the accessible mine provide continues to dwindle.

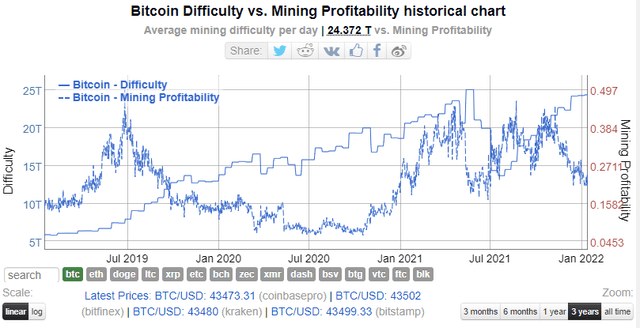

bitinfochart.com

Given the present enhance in mining issue coupled with the sharp value declines within the asset, miners now discover themselves at 6-month profitability lows. Whereas there is definitely no assure profitability has to extend from right here, I feel miners will be capable of assist push Bitcoin costs again up by controlling the move of the cash in an try to defend their margin.

Inventory to move

The inventory to move mannequin has been popularized by individuals like nameless Bitcoin analyst Plan B and The Bitcoin Customary creator Saifedean Ammous. Whereas the metric definitely shouldn’t be taken as an absolute measure of Bitcoin’s worth, we do presently discover a reasonably large discrepancy between the place Bitcoin is and the place the mannequin says it ought to be.

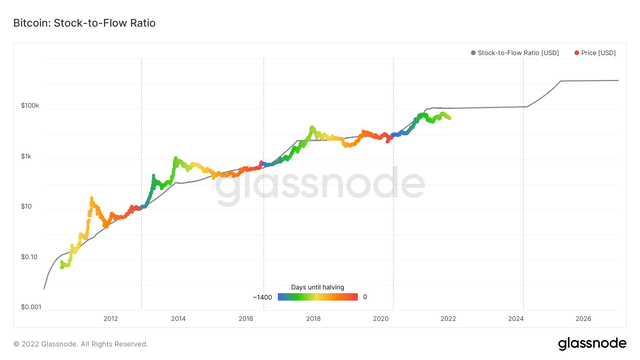

Glassnode

At just a little underneath $109,400 per coin, Bitcoin must almost triple in greenback valuation to re-visit the inventory to move estimate. Bitcoin hasn’t actually sniffed the inventory to move projection in near 10 months. This is able to point out the mannequin is both damaged or Bitcoin is due for a large transfer up in value. Given the rise in hash-rate, I imagine miners will push value will increase since they management the move of newly minted cash.

The long-term view

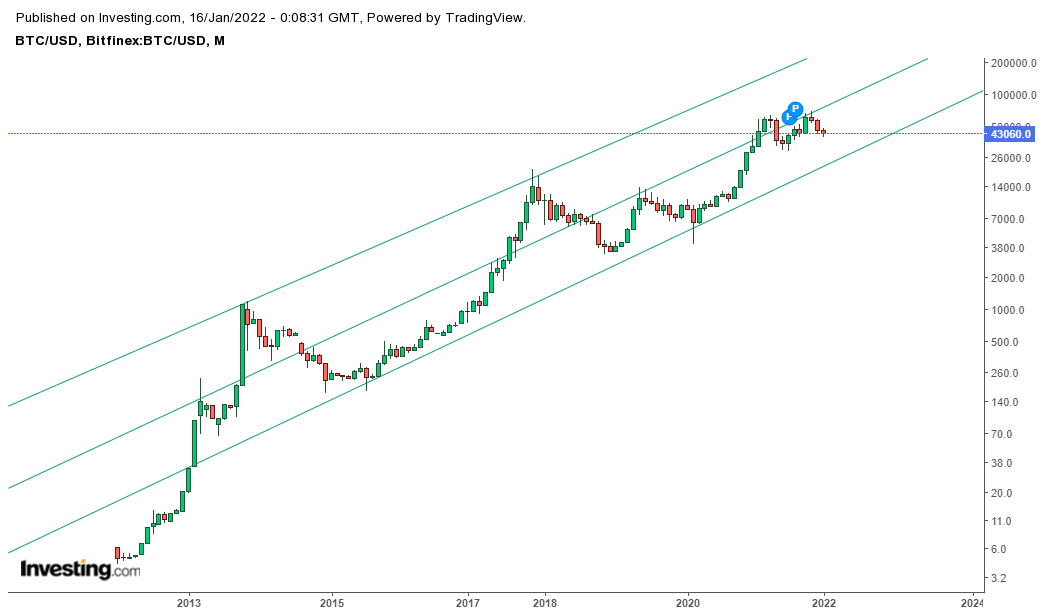

Once you have a look at Bitcoin on a logarithmic scale over the course of a number of years, you may get a way of when Bitcoin is nearing long-term development assist and resistance ranges.

investing.com

Bitcoin has clearly struggled to interrupt out and will doubtlessly even retest the decrease vary of the multi-year uptrend. That may theoretically put the value of Bitcoin someplace between $25-30k between now and April. That mentioned, I do not imagine that’s the most definitely situation.

Dangers

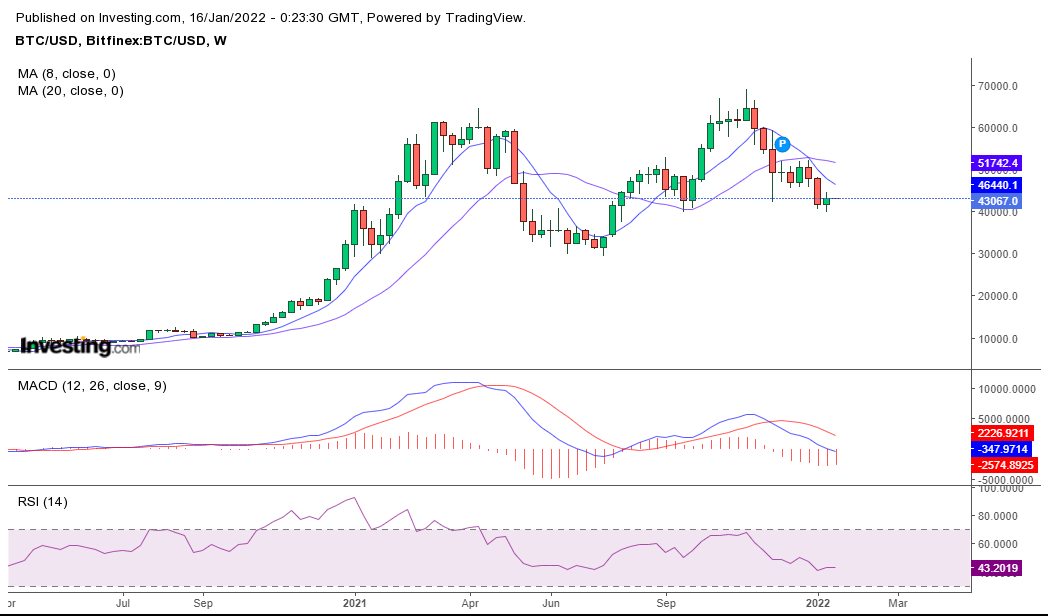

Nothing is with out threat and the identical is true for Bitcoin. Although I’ve a long-term core place that I commonly add to, the technical indicators that I’ve usually had my eye on on this secular bull run do not look terrific.

investing.com

I’ve favored the 8-week and 20-week shifting averages when making medium-term selections. Bitcoin closing above the 8-week shifting common would give me much more confidence going ahead. I do imagine that can occur however I see potential resistance on the 20-week shifting common. Failure to get above that line would possible verify a bearish head and shoulders sample. An in depth above would set us up for a take a look at of earlier highs.

There’s additionally the priority that there might be some form of regulatory motion that has a damaging influence on Bitcoin’s legality in the US. As Congress and the market await a crypto/CBDC report from the Federal Reserve, there’s all the time the chance that lawmakers or the SEC might create issues for the cryptocurrency area with out the Fed’s assist.

Conclusion

Cryptocurrency will not be for everybody. Understanding the connection between mining profitability, hash-rate, and value is crucial to understanding the present elementary setup in Bitcoin. Whereas I imagine decrease costs within the asset might doubtlessly occur, I feel there’s a increased chance for miners to push for a rise in mining profitability within the quick run. Long run, profitability will proceed to say no however there shall be ebbs and flows.

Whereas the inventory to move mannequin ought to by no means be the only catalyst one seems to be at when deciding when to enter a Bitcoin place, when you imagine the concept that the mannequin is a justification for actual worth at any given time, going lengthy spot right here appears to be a reasonably uneven wager that will favor bulls. I’ve elevated my spot place in current days and can proceed to take action on any additional weak spot.

Bitcoin will go up as a result of it should to take care of a safe community. The China precedent has been set and it has arguably strengthened the bull case for Bitcoin community safety. It wasn’t that way back that China accounted for over 70% of the Bitcoin hash-rate. The nation has since punted on Bitcoin mining solely but the community has stabilized and continues to chug alongside. As mining operations develop, hash-rate figures to proceed to rise. In the end which means the value of Bitcoin should do the identical.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Figure Heloc

Figure Heloc  Lido Staked Ether

Lido Staked Ether

Be the first to comment